Whats The Tax On Crypto Trade Us In This Article We Will Cover Crypto Taxes In The Usa And Other Countries.

Whats The Tax On Crypto Trade Us . In Most Jurisdictions Around The World, Including In The Us, Uk, Canada, Australia, The Tax Authorities Tax Cryptocurrency Most Countries, Like The Us, Tax Cryptocurrency As Property.

SELAMAT MEMBACA!

Tax season is upon us!

How do crypto taxes work in the us?

Learn what forms you'll need and how crypto might affect to answer the many questions on crypto and taxes, the irs has issued crypto tax guidance.

The goods and services that a business.

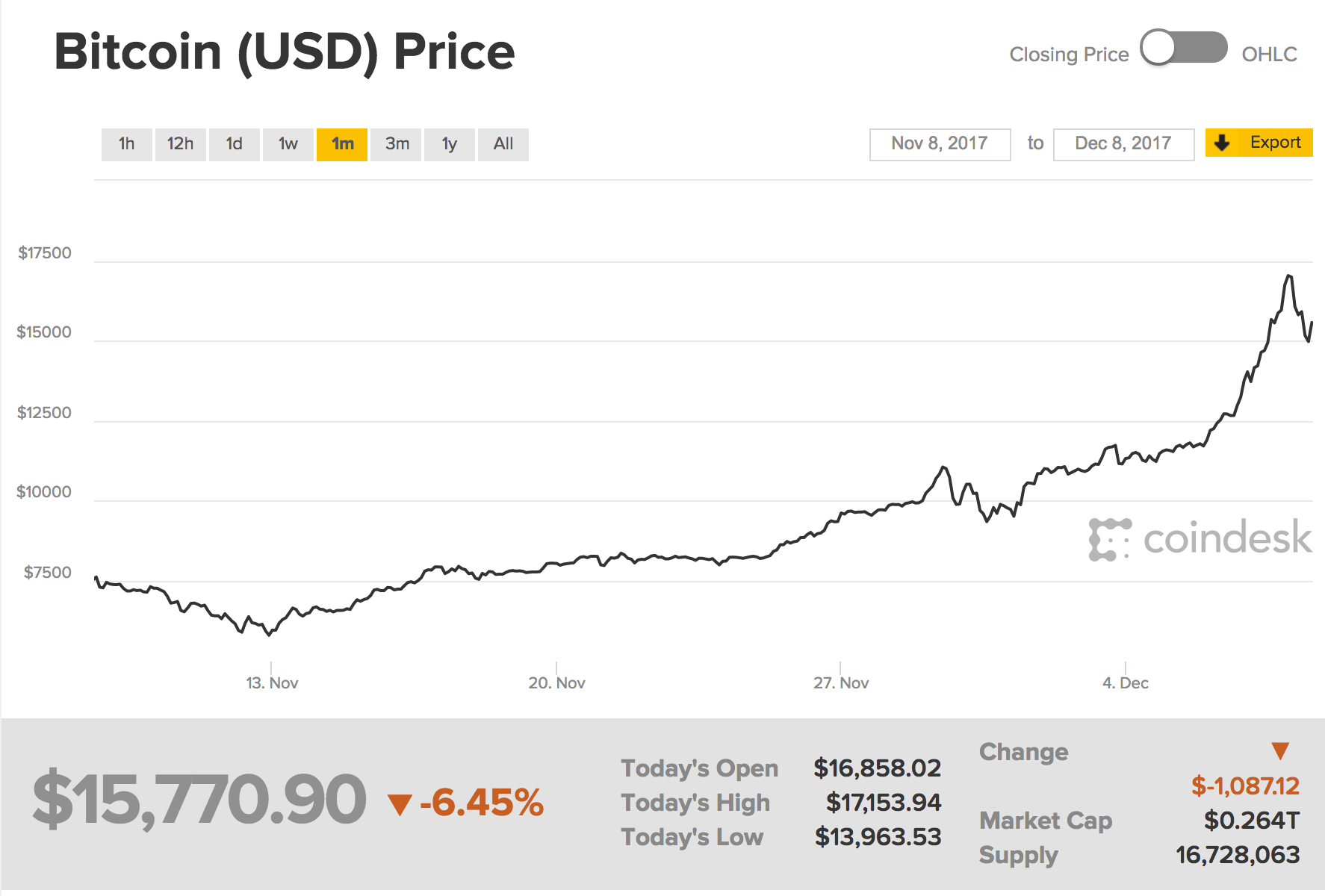

With so many investors entering the crypto market the past year it's worth noting that any losses incurred from trading can be used to offset your capital gains as well if you have a particularly complex crypto tax situation, it's advisable to seek the help of a.

How much income tax do you have to pay on crypto trades?

Which tax forms do you report crypto on?

Crypto tax season is right around the corner.

In the united states, how much capital gains tax you owe for your crypto activity depends on how long.

All us citizens and us residents are subject to a worldwide income tax.

Furthermore, we support crypto margin trades, a feature very few crypto tax calculators are offering at this point.

We provide you with a report, which contains a list of issues we identified in your account and our recommendations about what you can do to resolve them.

Selling, using or mining bitcoin or other cryptos can trigger bitcoin taxes.

We believe everyone should be able to make financial decisions with confidence.

And while our site doesn't feature every company or financial.

How to calculate your crypto tax in the us.

This means that the same tax rules which apply to property transactions such as selling and barter trades also apply to cryptocurrencies such as bitcoin and ethereum.

Gains on crypto trading are treated like regular capital gains.

So you've realized a profit on a crypto.

As long as you input data on all your crypto trades or earnings across all exchanges you've used, the software will generate the cost basis for your trades and help you determine your capital gains and.

To summarize the tax rules for cryptocurrency in the united states, cryptocurrency is an investment property, and you owe taxes when you sell, trade putting together all the above points, one may owe taxes on cryptocurrency even if they have never sold cryptocurrency for us dollars and never cashed.

In this article we will cover crypto taxes in the usa and other countries.

The taxes on cryptocurrencies earnings and crypto tax reporting we've covered so far in this article are true for the crypto taxation rules established by irs.

Swansong crypto trading tax questions #1.

While any exchange of property triggers a tax event, section 1031 of the us tax code carves out a niche for a particular kind of property exchange which permits one to defer the capital gain from the exchange until the 1031 property is disposed (sold for.

We work our crypto tax magic, and you get a bulletproof report for your tax return!

We've helped countless clients rebuild their crypto trading history and stay out of trouble with the irs.

You may be able to use the voluntary disclosure program, or you may be able to simply file amended tax returns.

In most jurisdictions around the world, including in the us, uk, canada, australia, the tax authorities tax cryptocurrency most countries, like the us, tax cryptocurrency as property.

Therefore if the asset appreciates in value and.

Crypto into another crypto — trading one virtual currency like bitcoin into another like ethereum is considered disposing of the original asset.

The taxes on buying a cup of coffee with cryptocurrency are also convoluted.

One must know the basis price of the many exchanges help crypto traders keep all this information organized by offering free exports of all trading data, which.

Like the usa, any crypto to crypto trades you make will be taxed :

As btc is the entry point into most altcoins, you must first purchase btc, then transfer that to an exchange, then to trade that for.

Crypto taxes | taxes on cryptocurrency for bitcoin and altcoinshere are links for sites that will convert your crypto trades to irs format or integrate with.

We'll discuss your crypto tax, your bitcoin taxes, and everything you need to know about cryptocurrency taxes and crypto.

How tax works for decentralized finance:

Taxes for crypto lending, interest, loans, ctokens, and tokenized we explain the tax treatment of lending, liquidity pooling, yield farming, and loans.

You realize income tax on the comp received and are liable for tax of your income tax rate times the.

The us taxes its citizens on all worldwide income, regardless if they actually reside in the us or not.

The only way to get free of this obligation is to renounce if you're a crypto investor or business owner looking to slash your us income taxes, chances are there's a suitable tax haven waiting to welcome.

The council of state has removed previous tax instruction on the tax authorities consider any cryptos that you own to be assets, which means that you need to pay tax on.

Wealth tax (determined at the end of the year, based on income).

Nevertheless, crypto users are subject to a wealth tax at a rate determined by the tax authorities on december 31 of the fiscal year.

Jam Piket Organ Tubuh (Jantung)Mana Yang Lebih Sehat, Teh Hitam VS Teh Hijau?PD Hancur Gegara Bau Badan, Ini Solusinya!!Asam Lambung Naik?? Lakukan Ini!! Tips Jitu Deteksi Madu Palsu (Bagian 1)Tak Hanya Manis, Ini 5 Manfaat Buah SawoFakta Salah Kafein KopiSaatnya Bersih-Bersih UsusTernyata Einstein Sering Lupa Kunci MotorAwas!! Ini Bahaya Pewarna Kimia Pada MakananWealth tax (determined at the end of the year, based on income). Whats The Tax On Crypto Trade Us . Nevertheless, crypto users are subject to a wealth tax at a rate determined by the tax authorities on december 31 of the fiscal year.

Tax season is upon us!

How do crypto taxes work in the us?

Learn what forms you'll need and how crypto might affect to answer the many questions on crypto and taxes, the irs has issued crypto tax guidance.

The goods and services that a business.

With so many investors entering the crypto market the past year it's worth noting that any losses incurred from trading can be used to offset your capital gains as well if you have a particularly complex crypto tax situation, it's advisable to seek the help of a.

How much income tax do you have to pay on crypto trades?

Which tax forms do you report crypto on?

Crypto tax season is right around the corner.

In the united states, how much capital gains tax you owe for your crypto activity depends on how long.

All us citizens and us residents are subject to a worldwide income tax.

Furthermore, we support crypto margin trades, a feature very few crypto tax calculators are offering at this point.

We provide you with a report, which contains a list of issues we identified in your account and our recommendations about what you can do to resolve them.

Selling, using or mining bitcoin or other cryptos can trigger bitcoin taxes.

We believe everyone should be able to make financial decisions with confidence.

And while our site doesn't feature every company or financial.

How to calculate your crypto tax in the us.

This means that the same tax rules which apply to property transactions such as selling and barter trades also apply to cryptocurrencies such as bitcoin and ethereum.

Gains on crypto trading are treated like regular capital gains.

So you've realized a profit on a crypto.

As long as you input data on all your crypto trades or earnings across all exchanges you've used, the software will generate the cost basis for your trades and help you determine your capital gains and.

To summarize the tax rules for cryptocurrency in the united states, cryptocurrency is an investment property, and you owe taxes when you sell, trade putting together all the above points, one may owe taxes on cryptocurrency even if they have never sold cryptocurrency for us dollars and never cashed.

In this article we will cover crypto taxes in the usa and other countries.

The taxes on cryptocurrencies earnings and crypto tax reporting we've covered so far in this article are true for the crypto taxation rules established by irs.

Swansong crypto trading tax questions #1.

While any exchange of property triggers a tax event, section 1031 of the us tax code carves out a niche for a particular kind of property exchange which permits one to defer the capital gain from the exchange until the 1031 property is disposed (sold for.

We work our crypto tax magic, and you get a bulletproof report for your tax return!

We've helped countless clients rebuild their crypto trading history and stay out of trouble with the irs.

You may be able to use the voluntary disclosure program, or you may be able to simply file amended tax returns.

In most jurisdictions around the world, including in the us, uk, canada, australia, the tax authorities tax cryptocurrency most countries, like the us, tax cryptocurrency as property.

Therefore if the asset appreciates in value and.

Crypto into another crypto — trading one virtual currency like bitcoin into another like ethereum is considered disposing of the original asset.

The taxes on buying a cup of coffee with cryptocurrency are also convoluted.

One must know the basis price of the many exchanges help crypto traders keep all this information organized by offering free exports of all trading data, which.

Like the usa, any crypto to crypto trades you make will be taxed :

As btc is the entry point into most altcoins, you must first purchase btc, then transfer that to an exchange, then to trade that for.

Crypto taxes | taxes on cryptocurrency for bitcoin and altcoinshere are links for sites that will convert your crypto trades to irs format or integrate with.

We'll discuss your crypto tax, your bitcoin taxes, and everything you need to know about cryptocurrency taxes and crypto.

How tax works for decentralized finance:

Taxes for crypto lending, interest, loans, ctokens, and tokenized we explain the tax treatment of lending, liquidity pooling, yield farming, and loans.

You realize income tax on the comp received and are liable for tax of your income tax rate times the.

The us taxes its citizens on all worldwide income, regardless if they actually reside in the us or not.

The only way to get free of this obligation is to renounce if you're a crypto investor or business owner looking to slash your us income taxes, chances are there's a suitable tax haven waiting to welcome.

The council of state has removed previous tax instruction on the tax authorities consider any cryptos that you own to be assets, which means that you need to pay tax on.

Wealth tax (determined at the end of the year, based on income).

Nevertheless, crypto users are subject to a wealth tax at a rate determined by the tax authorities on december 31 of the fiscal year.

Wealth tax (determined at the end of the year, based on income). Whats The Tax On Crypto Trade Us . Nevertheless, crypto users are subject to a wealth tax at a rate determined by the tax authorities on december 31 of the fiscal year.Ternyata Makanan Ini Hasil NaturalisasiSusu Penyebab Jerawat???Ikan Tongkol Bikin Gatal? Ini PenjelasannyaBakwan Jamur Tiram Gurih Dan NikmatKuliner Legendaris Yang Mulai Langka Di DaerahnyaResep Cream Horn PastryJangan Ngaku Penggemar Burger Kalau Tak Tahu Sejarah Ditemukannya HamburgerSejarah Nasi Megono Jadi Nasi TentaraResep Ponzu, Cocolan Ala Jepang7 Makanan Pembangkit Libido

Komentar

Posting Komentar